Guest blog: Top tax tips for Airbnb rentals

As sharing economy becomes a widely accepted concept, more and more homeowners are coming on board to the world of home sharing. Having an extra income, or improving the rental yield of your investment property can be very exciting, but did you know that there are tax implications for Airbnb rentals?

This can be easily overlooked, as clear information on this topic is difficult to come by as the concept is still quite new. So we asked tax experts at Grant Thornton on their views and tips for short-term rentals.

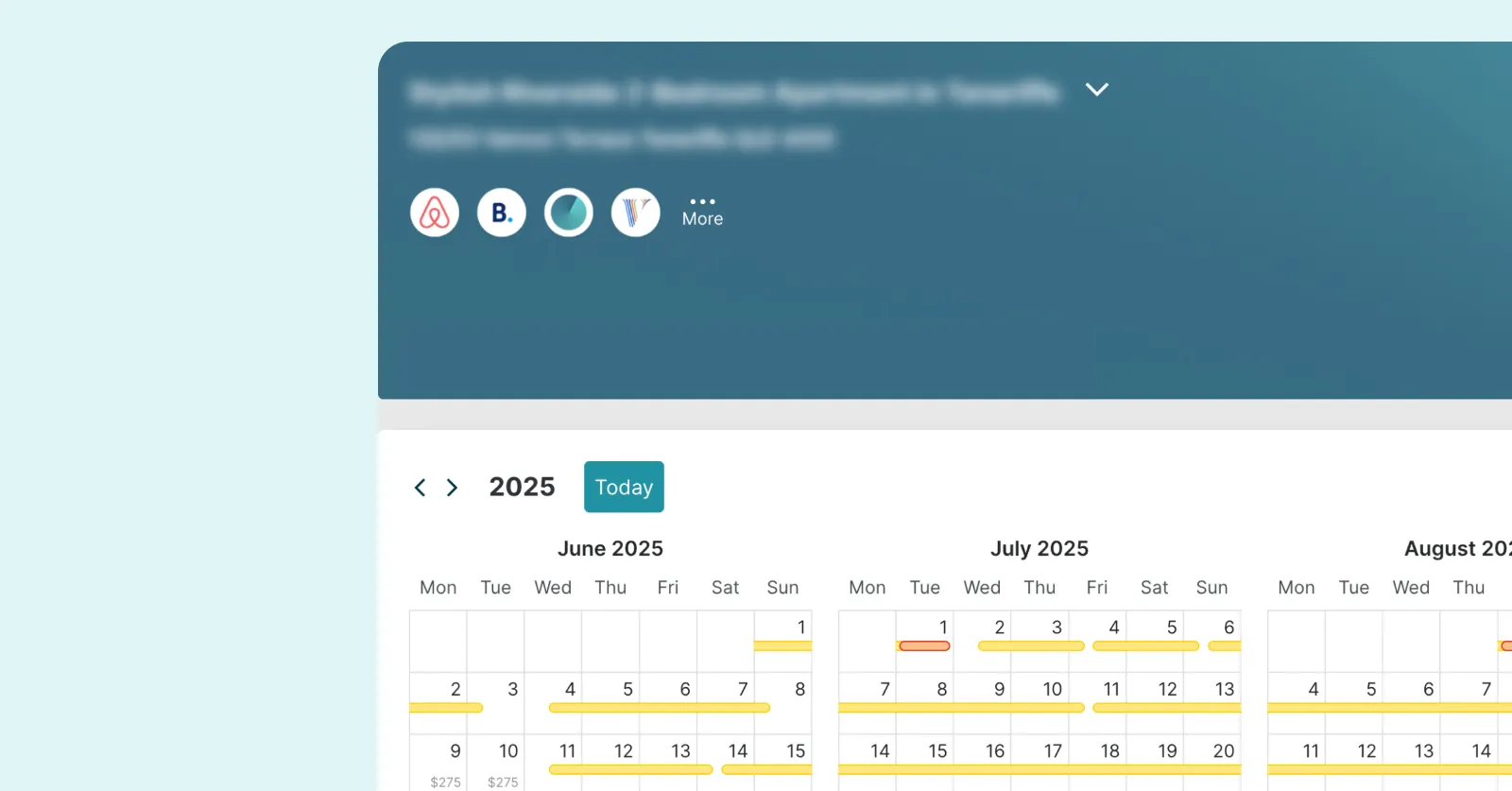

Short-term rentals have become an increasingly popular way of earning some extra income. Everyday Australians are using sites like Airbnb and Stayz to rent out their spare rooms and empty holiday houses.

However, hosts need to be aware that this source of income may attract tax. With the rising popularity of short-term rentals, the Australian Taxation Office (ATO) is cracking down on hosts, so there is a need to be vigilant. On the other hand, there may be an opportunity to receive a tax refund in relation to your short-term rental.

Key points to consider

If you are a host it is really important that you understand the tax consequences of your short-term rental in order to stay tax compliant while at the same time being able to identify opportunities to maximise your return.

Some key points to note are:

- Income from short term rentals is assessable

- Be careful of how the main residence exemption can be affected

- It is possible to negatively gear your short-term rental

- Keep your receipts as the expenses may be tax deductible

- Get advice from a tax professional

Short-term rental tax tips

Each of these points is explored in more detail below.

Treatment of income from short-term rentals

Any income you make from a short-term rental would be assessable income so be wary of treating this extra income as spending money. You might need to save up to 49% of your short-term rental income to fund the tax.

If you are advertising your short-term rental on Airbnb or Stayz, it is available for everyone to see including the ATO. The ATO can easily monitor your short-term rental, so it is really important that you declare your income. This would be the case even if you are only renting out the property for one day in the entire year.

Main residence exemption

Capital gains tax (CGT) is a tax you pay when you sell an asset such as property. Generally, you do not pay CGT when you sell the home you live in because of what is known as the main residence exemption.

However, if you are using part of your home as a short-term rental (e.g. a room or granny flat), your home will not be fully exempt from CGT. You may be required to apportion the gain (based on the size of the area rented out and the period of rent relative to the ownership period) and report an amount as a taxable gain.

A holiday home that you use as a short-term rental generally does not qualify for a CGT exemption. However, there could be an opportunity to treat it as your main residence. If you lived in it prior to renting it out you may treat it as your main residence for up to six years.

Short-term rental expenses may be tax deductible

Hosts are entitled to tax deductions for certain expenses they incur in running a short-term rental. Expenses that are directly associated with the short-term rental are fully deductible. For example:

Management fees charged by MadeComfy:

- Mortgage interest

- Council rates

- Insurance

- Cleaning

- Photography for advertising purposes

- Depreciation on furniture and appliances

- Utilities

However, to the extent, the property is used for private purposes than certain expenditure may need to be apportioned. Remember to keep a record of the expenses to ensure you can substantiate your claims.

Get advice from a tax professional

The above provides some general guidance. Every situation is different so as a host it is really important that you obtain advice from a tax professional who can review your situation and advise you on how to maximise your tax benefits in respect of the rental.

Conclusion

Short-term rentals can be a fantastic way to boost your income—but without the right tax strategy, you could end up with an unexpected bill instead of a windfall.

From assessable income to CGT implications and deductible expenses, staying on top of your tax obligations is key to maximising your returns.

.webp)

.png)

.png)

![[Video] Why is short-term rental the best choice for your property?](https://cdn.prod.website-files.com/62424e2368138bbce27b7ba7/64895ae54325bd7562bd62d8_62e0aeef16206d318472f2fd_46.jpeg)

![How to write the perfect Airbnb listing [Guide]](https://cdn.prod.website-files.com/62424e2368138bbce27b7ba7/64895adb9095455fa4c59e07_62e08c76f7203c3deae22bb0_53.jpeg)

![[Video] Airbnb maintenance for short-term rentals](https://cdn.prod.website-files.com/62424e2368138bbce27b7ba7/64895adcc0a2086ed3dff11a_62de105e132cbef04c318949_70.jpeg)

![What to offer Airbnb guests - [7 essential tips]](https://cdn.prod.website-files.com/62424e2368138bbce27b7ba7/64be134b0499d4b9ed58a4cd_64a4c32e14f9983555bf52b9_What%2520to%2520offer%2520Guests%2520-%25207%2520essential%2520tips.jpeg)

![[Infographic] Airbnb guest expectations](https://cdn.prod.website-files.com/62424e2368138bbce27b7ba7/64895ae0c0a2086ed3dff469_62d79f3be7b9b7b86e7b6b11_60.jpeg)

.jpeg)